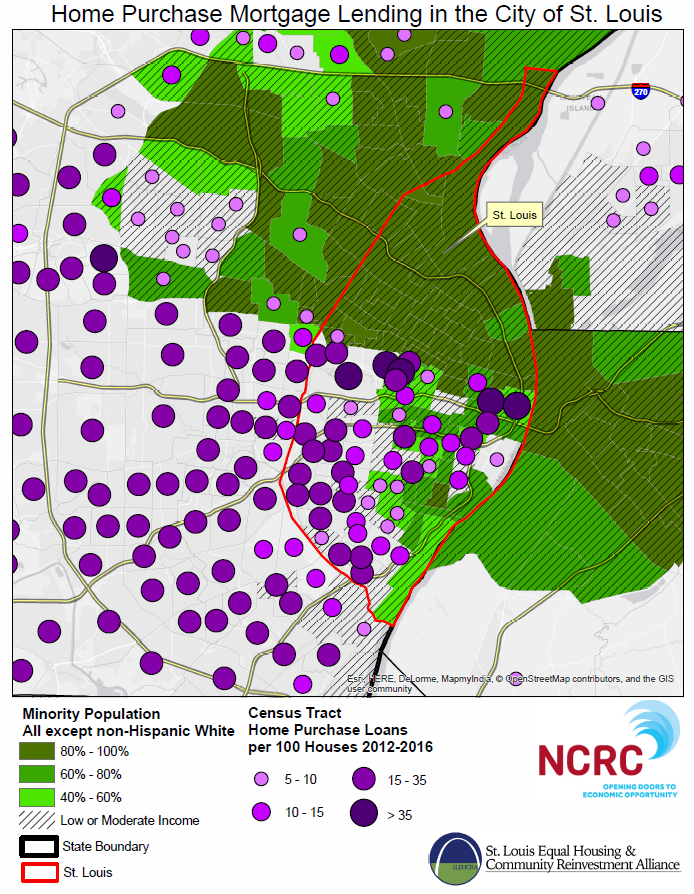

Feb. 15, 2018 — The St. Louis Equal Housing and Community Reinvestment Alliance (SLEHCRA) welcomes today’s major national story on the persistence of redlining in our nation’s real estate finance system. SLEHCRA has spent years working to improve access to credit and banking services in our metropolitan area’s communities of color. In recent years, we’ve highlighted respected national housing policy groups, such as National Community Reinvestment Coalition (NCRC) the Urban Institute, whose data analyses show almost no mortgage activity in North St. Louis. The most recent maps continue to show this striking trend.

The coalition co-chairs offered the following reactions to today’s news.

“Upon the release of today’s finding by Center For Investigative Reporting, SLEHCRA is sad to say that nothing in the story surprises our coalition members. We have long pointed to the continued lack of lending in Northern St. Louis neighborhoods, both in the city and county. We have also pointed out that many of the branches opened in recent years are in rapidly gentrifying neighborhoods, meaning that the new branches are serving neighborhoods that are growing increasingly whiter and wealthier and not the majority Black neighborhoods, where more of the low and moderate income families that the Community Reinvestment Act (CRA) is intended to benefit reside. As American household wealth is largely found in families’ home equity, we know that this problem not only closes the door on the “American Dream” of homeownership, it also reinforces a system that keeps minority families trapped in a cycle of intergenerational poverty.” Elisabeth Risch, SLEHCRA Co-Chair, representing the Metro St. Louis Equal Housing and Opportunity Council (EHOC)

“We reiterate our calls for more branches opening in the St. Louis metropolitan area’s predominantly Black communities, the establishment of a “greenlining fund”, and other programs and investments aimed at increasing credit access in the Black community. Lending in our majority minority neighborhoods is lower than in generations. We hope that this research is call to action that brings lenders, nonprofits and community leaders to the table for a real discussion about what needs to be done to create an equitable lending ecosystem in St. Louis. SLEHCRA stands ready to help in efforts to lead our region forward towards a more equitable future.” Jackie Hutchinson, SLEHCRA Co-Chair, representing the Consumers Council of Missouri

###