October 30, 2018 – The St. Louis Equal Housing and Community Reinvestment Alliance (SLEHCRA) submitted public comments asking federal regulators only approve Busey Bank’s acquisition of TheBANK of Edwardsville in the event of Busey signing a Community Benefits Agreement (CBA). This decision was made after extensive internal discussion with Busey representatives and is based on the worsening performance of Busey’s lending to low- and moderate- income borrowers. Busey entered the St. Louis market by purchasing Pulaski Bank, which was an industry leader in serving low- and moderate- income borrowers and communities. Likewise, TheBANK of Edwardsville is an innovative leader in serving the needs of the community and coalition members are concerned the merger will dilute those best practices.

“When Busey Bank arrived in our city, their executives gave our coalition members broad assurances that the CRA performance of the formerly Pulaski Bank branches wouldn’t suffer and would be bolstered by the size of the Busey. Instead, we saw a formerly industry leader replaced by a lending institution that now lags behind their peers in the St. Louis metropolitan area. It is due to this track record that our coalition is seeking a Community Benefits Agreement with Busey as part of their acquisition with TheBANK of Edwardsville. It is imperative that the low- and moderate- income communities of St. Louis have access to banking services and credit. This merger is an opportunity for Busey Bank to create a significant plan setting forth clear and specific measurable goals that can make a huge impact on access to financial services and investment in low- and moderate-income communities and communities of color,” said Elisabeth Risch, SLEHCRA Co-Chair, representing the Metro St. Louis Equal Housing and Opportunity Council (EHOC).

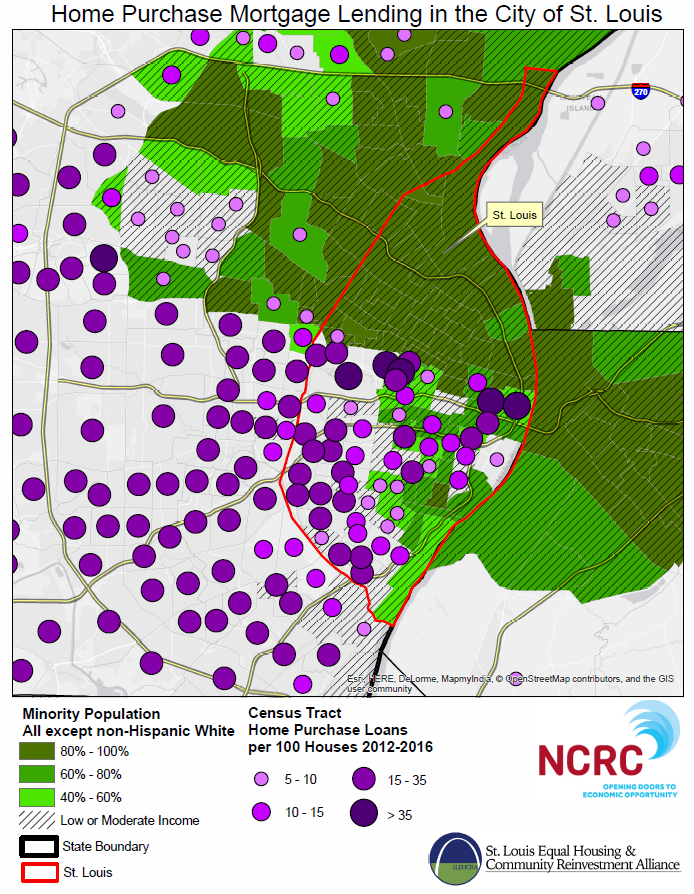

Additionally, advocates will use this moment to speak to the importance of not only protecting, but strengthening the Community Reinvestment Act (CRA). As the Office of the Comptroller of the Currency is looking to change how banks are examined and assessed under the CRA, SLEHCRA hopes to raise awareness of this potential threat to local CRA investments. Local advocates point out that the National Community Reinvestment Coalition (NCRC)’s recent report shows that potential changes could cost Missouri’s first congressional district as much as $320 million in lending over a five year period. “This could devastate neighborhood stabilization and drive African American homeownership rates even lower. This will only increase the massive wealth gap between black and white households. It is also important to note that strengthening the CRA was a call to action in the Forward Through Ferguson report. We hope regional leaders join our coalition members in submitting comments that encourage a strengthening, not weakening, of the CRA during this regulatory review period. Protecting and strengthening the CRA is something that matters to St. Louis. We need to make sure that the OCC understands how valuable this investment is to low- and moderate- income communities across the St. Louis metro,” said Rose Eichelberger, SLEHCRA Member, representing R.A.A. – Ready, Aim, Advocate.

###