Bailing Out on Community Reinvestment

While the subprime mortgage boom and bust has been well documented, less attention has been paid to the practices of prime lenders, the brick and mortar banks that are now also struggling as a result of the subprime meltdown. These lenders are now eligible for taxpayer funds under the U. S. Treasury’s Troubled Assets Relief Program (TARP) that Congress authorized through the $700 billion Emergency Economic Stabilization Act.

In its Dec. 2008 study “Bailing Out on Community Reinvestment,” the Metropolitan St. Louis Equal Housing Opportunity Council examined the recent fair lending record of St. Louis-area lenders that have applied for or expressed an interest in applying for TARP funds.

Noted Attorney Michael Allen to Present CDBG Administrators Workshop

EHOC sponsors a workshop on “Affirmatively Furthering Fair Housing” for CDBG Administrators on Tuesday, March 23, 2010, from 9 AM to Noon presented by attorney Michael Allen.

Michael Allen is a partner with Relman & Dane in Washington DC. He was a lead attorney in the case Anti-Discrimination Center v. Westchester County, in which a fair housing agency sued a suburban county for misrepresenting that they were affirmatively furthering fair housing.

From 1995 to 2006, Allen was senior staff attorney and director of the fair housing program at the Bazelon Center for Mental Health Law and co-director of the Building Better Communities Network. From 1985-1995 he was a staff attorney and managing attorney at Legal Services of Northern Virginia. A nationally recognized expert on the disability provisions of the Fair Housing Act, Michael has litigated and lobbied at the federal and state levels, and appeared in national print and electronic media. He is a 1979 graduate of Georgetown University School of Foreign Service, and received his law degree in 1985 from the University of Virginia. He is admitted to practice in the District of Columbia and Virginia.

The training is free and open to CDBG administrators for municipal, county or state government officials. To register, contact Mira Tanna at 314-534-5800 ext. 26 or send an email to [email protected] with “CDBG Registration” in the subject line.

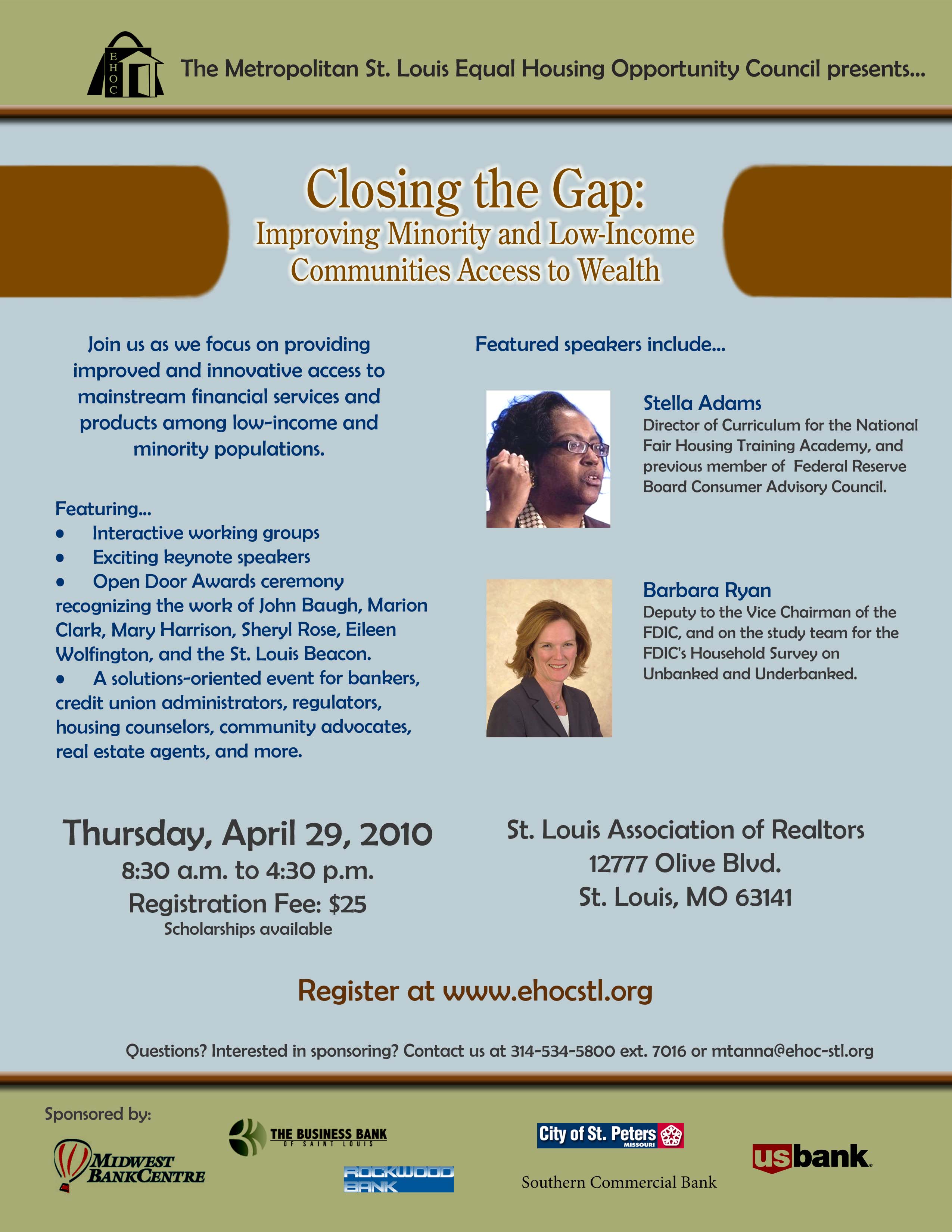

Stella Adams confirmed for “Closing the Gap”

Stella Adams has been confirmed as a featured speaker for the 13th Annual Regional Fair Housing Training event.

Stella Adams is a nationally recognized leader in the fair housing and community reinvestment arena. As executive director of the North Carolina Fair Housing Center, she helped recover over $60 million for victims of predatory lending and $3 million for victims of housing discrimination.

Adams has served on the Federal Reserve Board Consumer Affairs Advisory Council, on the board of the Community Reinvestment Association of North Carolina and the board of the National Community Reinvestment Coalition.

Other speakers to be announced soon!

Registration is available online through acteva or you can send a check for registration with name, organization, phone number, email address, meal preference (meat or vegetarian) and any accommodations needed to:

EHOC / Closing the GAP

1027 South Vandeventer Ave., 6th Fl

St. Louis, MO 63110.

Register for Closing the GAP

The Metropolitan St. Louis Equal Housing Opportunity Council and SLEHCRA present the 13th Annual Regional Fair Housing Training in honor of Fair Housing Month. This year’s theme is “Closing the GAP: Improving Minority and Low-Income Communities Access to Wealth.”

The event will take place at the St. Louis Association of REALTORS, 12777 Olive Blvd., St. Louis, MO 63141. Registration is $25 and includes lunch; there is a reduced fee for SLEHCRA member organizations.

Attendees can register online through acteva or can send a check for registration with name, organization, phone number, email address, meal preference (meat or vegetarian) and any accommodations needed to:

EHOC / Closing the GAP

1027 South Vandeventer Ave., 6th Fl

St. Louis, MO 63110.

The conference is supported by the City of St. Peters, Central Bank of Kansas City, and Midwest BankCentre. If you are interested in sponsorship, please contact:

Mira Tanna

314-534-5800 ext. 26 or

![]()

Join us!

We meet on a monthly basis, on the last Wednesday of the month from 10 a.m. to 12 p.m.

Contact us for more information at [email protected] or at 314-534-5800.

SLEHCRA is open to non-profit community and neighborhood organizations in Missouri and Illinois that work in the Metropolitan St. Louis area.

SLEHCRA in the news!

Check out recent articles about SLEHCRA’s activities with Midwest BankCentre:

- St. Louis American: “Housing alliance calls out Midwest BankCentre for not loaning to blacks“

- St. Louis Post-Dispatch: “Midwest BankCentre bias? Data suggest it, coalition says”

- St. Louis Business Journal: “Midwest BankCentre lending practices under fire”

- St. Louis Beacon: “Living Apart: Equal access to money makes a big difference“

- St. Louis Public Radio (KWMU): “Local Bank accused of ‘redlining’“

St. Louis Media Covers FDIC Study of Racial Disparities

The Metropolitan St. Louis Equal Housing Opportunity Council (EHOC) issued a press release after the FDIC report was released, in order to raise awareness in the St. Louis area about the significance of this report. As a result of the press release, stories were carried in the St. Louis Post-Dispatch business pages as well as column by David Nicklaus, the St. Louis American, the St. Louis Business Journal, KMOX, and KSDK News Channel 5.

SLEHCRA and the EHOC is grateful to these news organizations for covering this issue.

FDIC Study Highlights Racial Disparities in Metro St. Louis for those who are Unbanked

On December 2, 2009, the FDIC released its National Survey on Unbanked and Underbanked Households. The survey examined the number of households in the United States that do not have checking or savings accounts (unbanked) as well as the number of households that have a checking or savings account but use alternative financial services such as non-bank money orders and check cashing services, payday loans, refund anticipation loans, pawn shops and rent-to-own agreements (underbanked).

Nationally, the study found that 7.7 percent of the population is unbanked, and a further 17.9 percent are underbanked. The study found a high disparity between racial groups, finding 21.7 percent of black, 19.3 percent of Hispanic and 15.6 percent of American Indian / Alaska Native households to be unbanked compared to 3.5 percent of Asian and 3.3 percent of white households that are unbanked. The percentage of St. Louis households that are unbanked is slightly lower than the national average (7.5 percent); however, the racial disparities are more significant than in any other metropolitan area, with 31.0 percent of black households in the St. Louis region being unbanked, compared to 1.1 percent of white households. The percentage of African American households that is unbanked in St. Louis is higher than for any other metropolitan region in the country (see table 4.2, page 24).

Commenting on the report, Mira Tanna, Assistant Director of the Metropolitan St. Louis Equal Housing Opportunity Council said: “The report shows that banks in the St. Louis region have done a poor job reaching out to African Americans. We have identified banks that exclude predominately African American areas from their service area and that choose to locate their branches only in predominately white neighborhoods. At the same time, many African American neighborhoods are littered with alternative financial services such as payday lenders and auto title loan companies that charge excessive interest rates. It is time for banks to offer equitable access to credit to African Americans in the St. Louis region.”

The disparities between blacks and whites in banking in the St. Louis area are not new. A 2000 study by the Center for Community Change found St. Louis to have the highest disparities among upper income blacks and whites in the use of subprime loan products.

EHOC helped form the St. Louis Equal Housing and Community Reinvestment Alliance (SLEHCRA) to help increase investment in low-income and minority communities in part by ensuring that banks are have facilities in and are lending to these communities, and that banks are offering products and services that meet the needs of low-income borrowers.

Press Release: SLEHCRA Files Public Comment Against Midwest BankCentre

For Immediate Release

October 5, 2009

Media Contact:

Elisabeth Risch 314-534-5800 ext. 22

Community Organizations File Public Comment Letter against Midwest BankCentre

ST. LOUIS – A coalition of community organizations called the St. Louis Equal Housing and Community Reinvestment Alliance (SLEHCRA) announced today that they had filed a public comment letter with the Federal Reserve Bank regarding Midwest BankCentre’s performance under the Community Reinvestment Act (CRA).

The public comment letter alleges that the bank does not provide equal access to services for African American communities; that the bank excludes areas of high minority concentration in its assessment area; that the bank has not approved mortgage loans to black borrowers in five years; and that the bank appears to treat borrowers differently according to race.

SLEHCRA gathered data through the Home Mortgage Disclosure Act (HMDA) showing that the bank has not approved a single mortgage loan to an African American borrower in five years (2004 – 2008), despite receiving applications from African Americans.

In the past 3 years (2006 – 2008), in contrast, 355 mortgage loan applications from white borrowers were approved. Also cited in the letter was the lack of services in African American communities. All full service branches are located in areas with less than 2.5% of African American households.

The bank also serves four retirement centers, one of which is located in a census tract that is 32% African American. However, these partial service locations are not open to the general public and do not issue credit.

SLEHCRA also noted that the bank’s assessment area appears to exclude areas of high concentration of minorities, leaving out large parts of St. Louis City and some parts of north St. Louis County in apparent violation of federal regulations for large banks that recommend the assessment area be designated as the entire metropolitan area or at least within entire political subdivisions.

Finally, the Metro St. Louis Equal Housing Opportunity Council (EHOC) conducted a “test” in which potential borrowers appeared to be treated differently because of race.

The potential black borrower received one customer service contact, while the potential white borrower received one customer service contact and 6 personally-generated contacts from the mortgage division, despite the black borrower having superior qualifications.

Founded in 1906 as Lemay Bank and Trust, the bank had assets of $958.5 million in 2007 and was examined as a large bank.

The bank is undergoing is performance evaluation this quarter by the Federal Reserve Bank. A negative rating can result in additional performance evaluations; delays or denials of mergers, acquisitions, or expansions of services; or enforcement activity by the U. S. Department of Justice.

# # #

For more information or to set up interviews, contact Elisabeth Risch at 314-534-5800 ext. 22.