ST. LOUIS, Mo. – Simmons Bank and the St. Louis Equal Housing and Community Reinvestment Alliance (SLEHCRA) have announced a Community Benefits Partnership to serve the needs of low-to-moderate-income (LMI) and minority communities within the St. Louis, Missouri, region.

“Simmons is committed to serving the needs of low-to-moderate-income and minority communities throughout our footprint,” said George A. Makris, Jr., chairman and CEO of Simmons First National Corporation, parent company of Simmons Bank. “We chose to work with SLEHCRA because of their extensive knowledge of the needs in St. Louis. Working together, we believe we can create opportunities for economic development and enhanced quality of life by expanding access to financial products for individuals and families in this region.”

This announcement follows Reliance Bank’s merger into Simmons Bank, which expanded Simmons Bank’s presence in the St. Louis region from three branch locations to 25 earlier this month.

“Simmons recognized the outstanding work that Reliance Bank had done partnering with SLEHCRA and is committed to community development excellence in St. Louis now that we’ve joined together,” said Allan D. Ivie, IV, St. Louis president of corporate banking and community affairs for Simmons Bank.

“SLEHCRA is thrilled to enter into another Community Benefits Agreement with a forward-thinking lender. These agreements build positive relationships between consumers and lenders, and these relationships help achieve sustainable growth for lenders who understand the value of working in low- and moderate-income neighborhoods and communities of color. By working together, we are building a stronger St. Louis region,” said Jackie Hutchinson, SLEHCRA co-chair and board president of the Consumers Council of Missouri.

“When two groups come together with the same goal, in this case to help ensure equal credit opportunities for minority and low- and moderate-income borrowers, we believe real change can happen,” said Makris. “Simmons and SLEHCRA are laser-focused on this goal, and we have worked together to come up with specific volunteerism and giving plans that we believe will help us get there.”

The three-year partnership agreement will begin May 1, 2019. As a part of the plan, Simmons Bank has committed to:

- Adding one new retail service location in an LMI census tract or census tract with a predominantly minority population in the St. Louis region.

- Hiring a full-time, dedicated CRA mortgage lender in the St. Louis market.

- Offering residential lending, small business lending, and checking and savings products and services that have special appeal to LMI and minority individuals.

- Origination goals for small business loans.

- Contributing a total of $15 million in qualifying community development investments within the St. Louis market. As a part of this commitment and the commitment to leadership in the Gateway Neighborhood Mortgage program, Simmons plans to make an investment of $500,000 in the Gateway Neighborhood Mortgage loan fund.

- Funding contributions of $60,000 annually in CRA charitable giving in the St. Louis market.

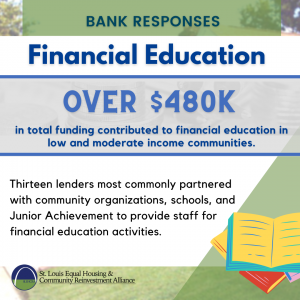

- Engaging in financial literacy activities and targeted technical assistance with nonprofit organizations.

Read the full Partnership Agreement here.

About Simmons Bank

Simmons Bank is an Arkansas state-chartered bank that began as a community bank in 1903. Through the decades, Simmons has developed a full suite of financial products and services designed to meet the needs of individual consumers and business customers alike. Simmons has grown steadily to approximately $16.5 billion in assets (as of Dec. 31, 2018) and today operates approximately 200 branch locations throughout Arkansas, Colorado, Kansas, Missouri, Oklahoma, Tennessee and Texas. Simmons is the subsidiary bank for Simmons First National Corporation (NASDAQ: SFNC), a publicly traded bank holding company headquartered in Pine Bluff, Arkansas. For more information, visit http://www.simmonsbank.com/.

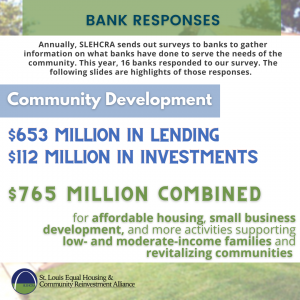

About SLEHCRA

The St. Louis Equal Housing and Community Reinvestment Alliance (SLEHCRA) is a coalition of nonprofit and community organizations in the St. Louis metropolitan area. SLEHCRA works to increase investment in minority communities, regardless of income, and in low- and moderate-income communities, regardless of race, by ensuring that banks are meeting their obligations under the Community Reinvestment Act and fair lending laws. Additional information is available at www.slehcra.org.

###

The St. Louis Equal Housing and Community Reinvestment Alliance (SLEHCRA) is a coalition of non-profit and community organizations in the St. Louis metropolitan area.

The St. Louis Equal Housing and Community Reinvestment Alliance (SLEHCRA) is a coalition of non-profit and community organizations in the St. Louis metropolitan area.